2026 Market Outlook & Year in Review

THE PRESSURE

POINT

Housing Supply, Migration, &

the Missing Middle

2026 Market Outlook

Watch these short videos and hear where the GTA housing market is headed in 2026 from TRREB’s Chief Information Officer Jason Mercer.

Access the presentation slides and watch the recap video of TRREB’s 2026 Market Outlook and Year in Review event.

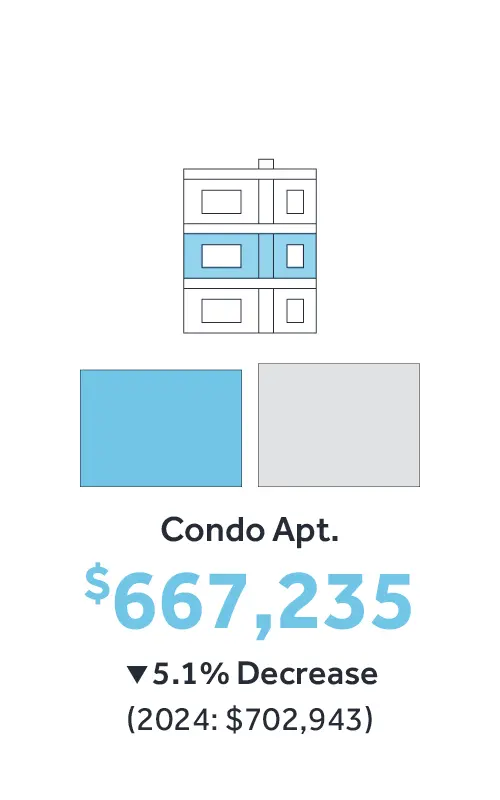

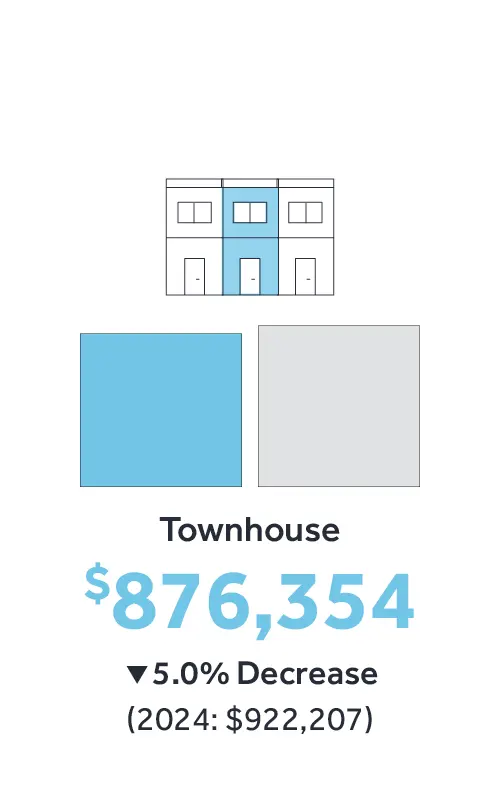

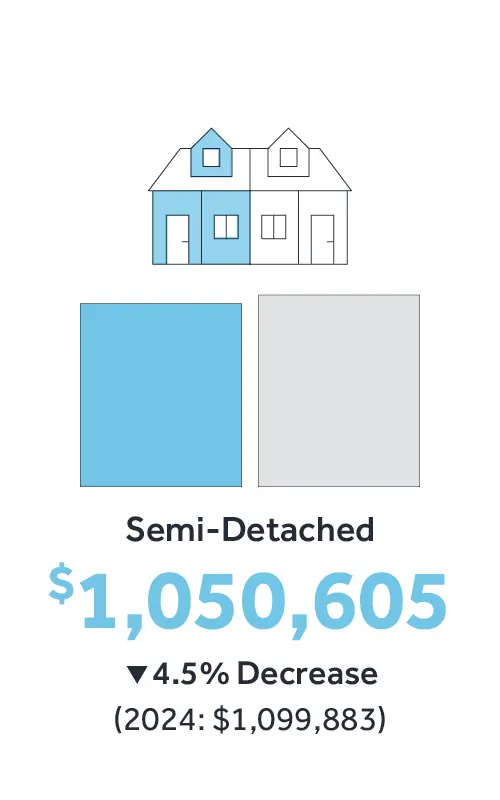

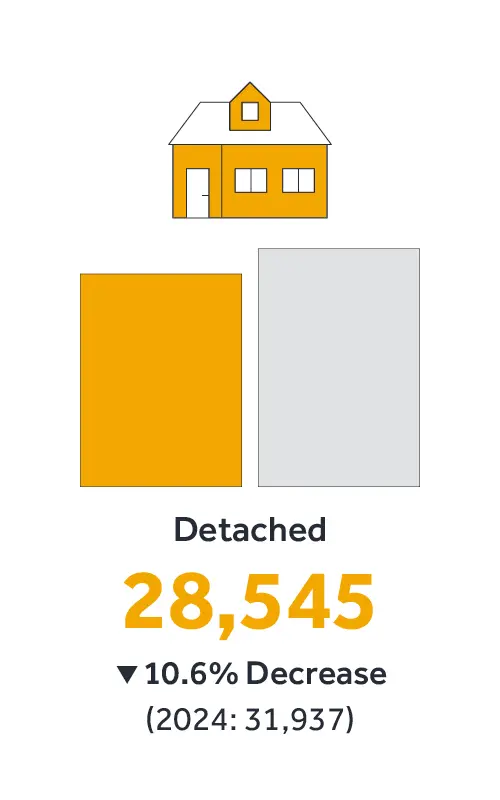

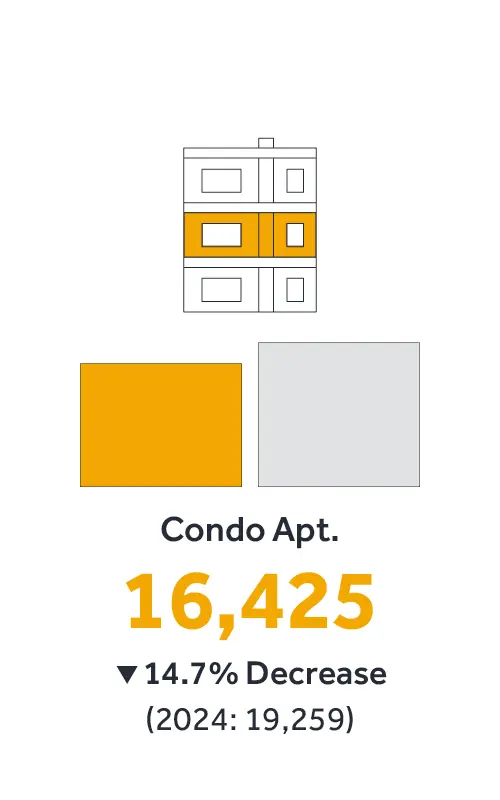

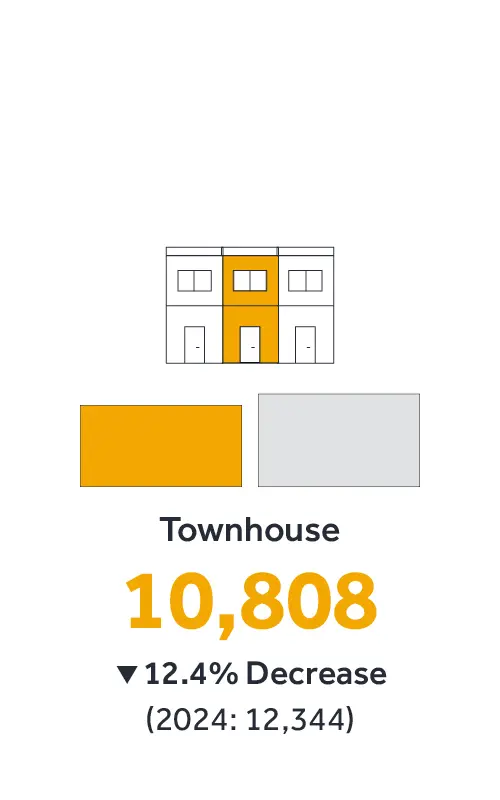

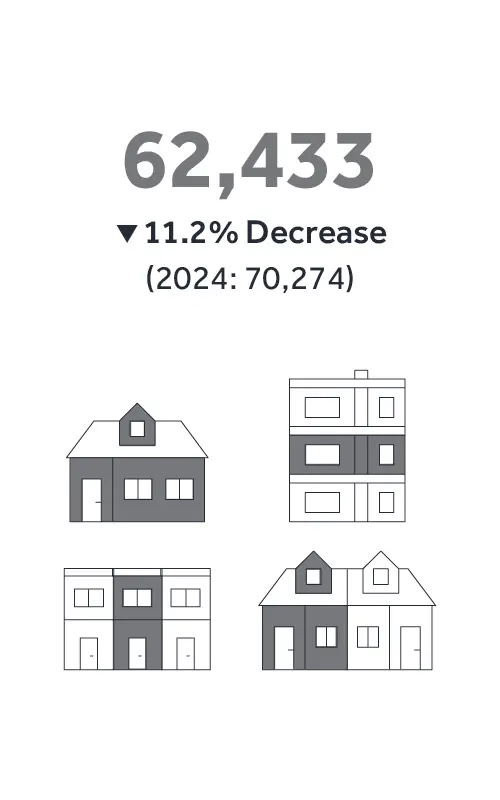

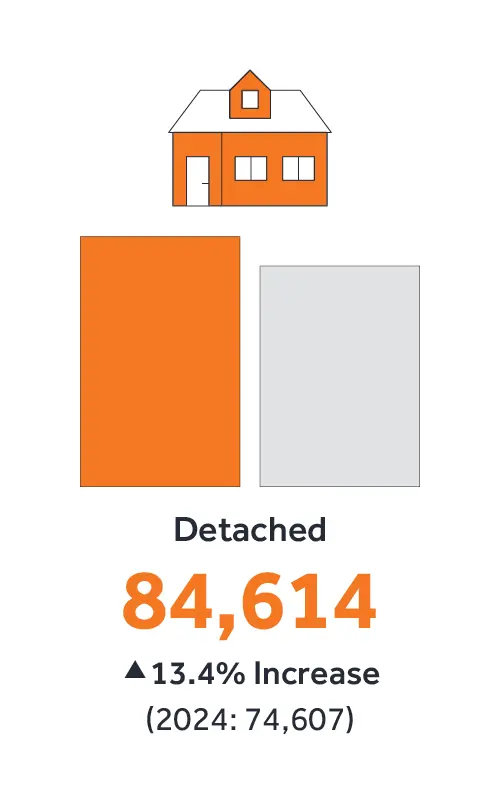

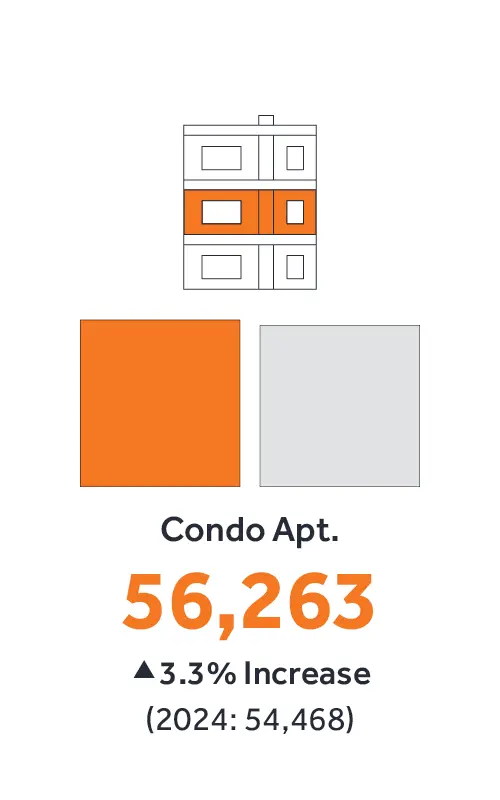

2025 Year in Review

Get a glimpse of total home sales, new listings, and average prices for 2025.

Market Outlook and Consumer Intentions

Discover five things you need to know about what’s next for the housing market in 2026.

Plus, find new insights from TRREB’s latest buying and selling intentions survey conducted by Ipsos.

60K-70K

projected number of home sales.

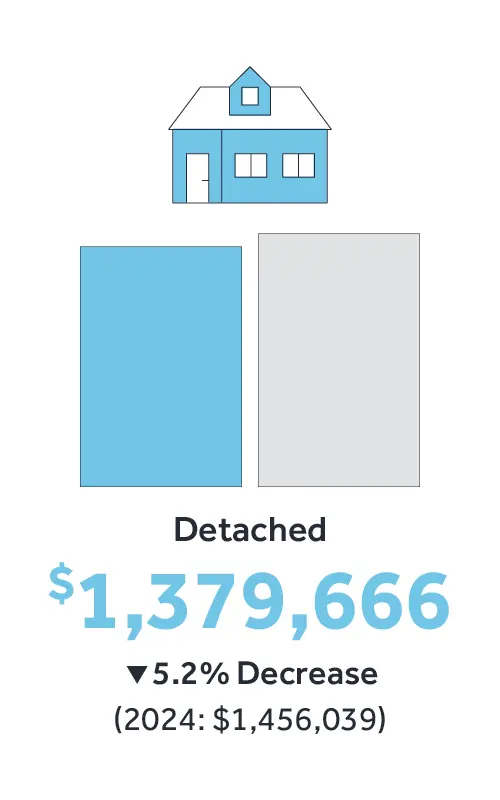

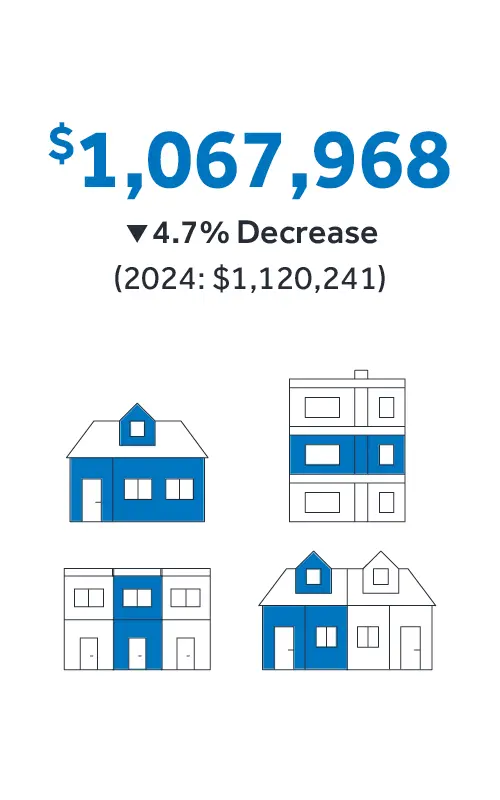

$1M-$1.03M

average price forecast range for homes in the GTA.

22%

of survey respondents said they intend to buy a home in 2026.

45%

of intending buyers said they will be first-time buyers.

$589

gap between affordable monthly mortgage payments and the mortgage required to purchase an ideal home.

Remarks from Ontario Government Leaders

What Policymakers Are Telling TRREB

Click on each headshot to read solutions for housing affordability and supply issues.

Addressing Outmigration Trends and Solutions

People are leaving the Greater Toronto Area at an accelerating pace as housing affordability challenges, rising taxes, congestion, and shifting work patterns reshape where Ontarians choose to live. These pressures make it increasingly difficult for young families and working-age residents to remain in the region.

This report, prepared by Loyalist Public Affairs for the Toronto Regional Real Estate Board (TRREB), examines the key economic, housing, and quality-of-life factors contributing to outmigration from the GTA and outlines policy-focused solutions to support affordability, retain talent, and strengthen the region’s long-term competitiveness.

Interpreting Price Signals from Toronto’s Multiplex Zoning Reform

Toronto introduced citywide multiplex zoning in May 2023 to allow two- to four-unit homes as-of-right across most low-rise neighbourhoods. The policy aimed to support gentle density, reduce regulatory barriers, and expand housing supply within existing communities.

This report, developed in partnership with Toronto Regional Real Estate Board (TRREB) and researchers from the Massachusetts Institute of Technology (MIT) Centre for Real Estate (CRE), examines whether the zoning change influenced freehold land prices in Toronto. Using TRREB transaction data from 2018 to 2025, the analysis explores how the market responded to expanded redevelopment permissions.